Researched Models

This page presents evaluations of our market machine-learning models on unseen historical data. Each model was tested on price data it had not encountered during training to approximate real-world usage. Results are presented for research and analytical purposes only.

How to use this page

You should

- View model descriptions and outputs.

- See historical evaluation and saved artifacts.

- Compare each model against.

You should not

- Expect guaranteed performance.

- Assume a single best model always wins.

LSTM (Long Short-Term Memory)

Deep LearningA recurrent neural network baseline trained on sequential OHLCV data. Saved artifacts are reused for forward prediction.

How It Works

- Builds sliding windows of OHLCV inputs over the chosen lookback period

- Standardizes features using training data

- Trains a single LSTM layer with a small dense regression head

- Stores model + scalers for future prediction runs

Testing & Validation

Time Period

1 month

Dataset

Crypto + equities (varies by symbol)

Training Samples

Varies by window and timeframe

Outputs & Limits

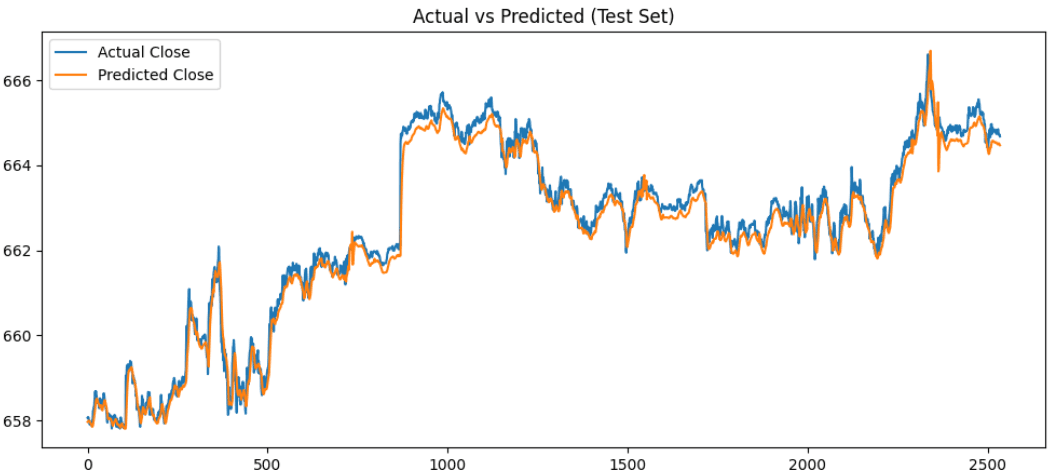

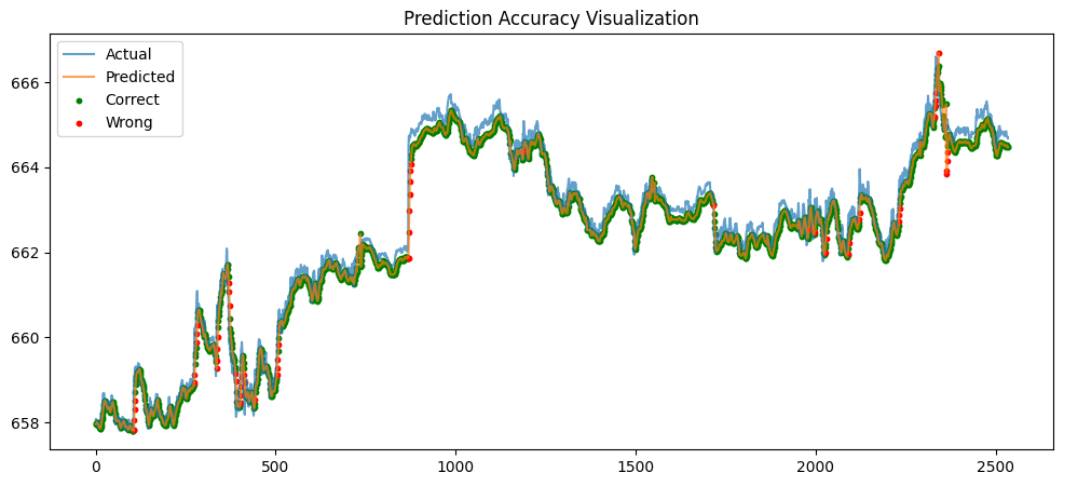

- RMSE, MAE, MAPE metrics per run

- Saved model artifacts for reuse

- Forecasts 10-20 future candles

Visualizations

Model Configuration

Checking access...

Note: All models have been tested on out-of-sample data to ensure realistic performance metrics. Past performance does not guarantee future results. These models are implementations based on academic research and have been adapted for our trading platform.